Employment & Visa Stability — Key Factors for Home Loan Approval in Japan

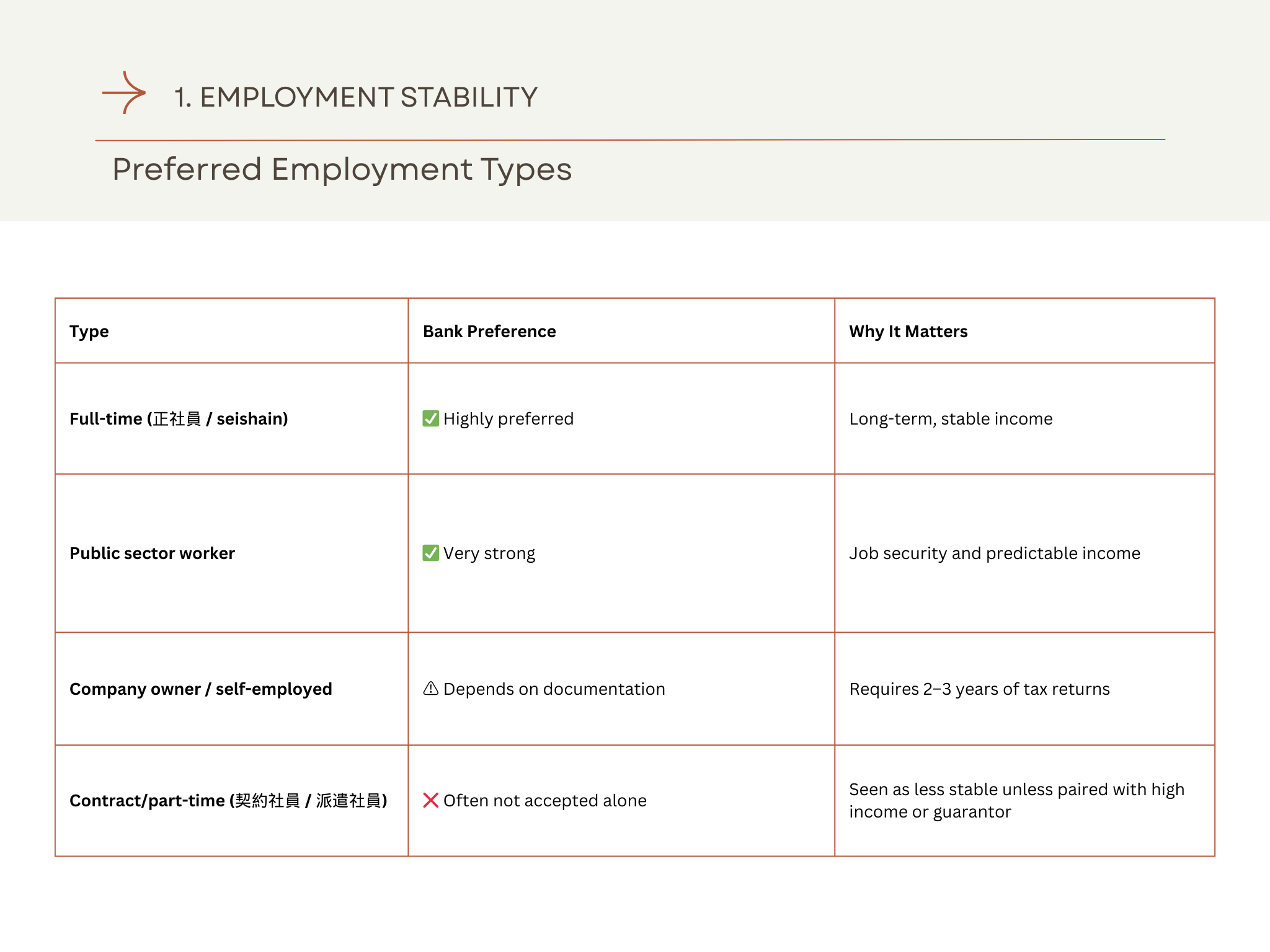

When applying for a home loan in Japan, employment type and visa status are two of the most critical criteria banks evaluate to assess your financial stability and long-term residency potential.

Important:

PR is not required by all banks — some accept non-PRs if other factors are strong (e.g., Shinsei Bank, Tokyo Star Bank).

Some lenders may ask you to:

Show visa renewal history

Have several years left on your current visa

Provide a co-borrower or guarantor (spouse with PR or Japanese nationality)

Tips to Improve your Chances

Provide stable tax returns (especially if self-employed or contract-based)

Secure a longer-term visa before applying (e.g., 3 or 5 years)

If possible, apply jointly with a Japanese spouse or PR co-applicant

Some companies specialize in foreigner-friendly home loans — Sumika Consulting, we will help to improve approval odds

Would you like a list of banks that are more flexible with visa requirements and employment types?