Investing in Real Estate in Japan is increasingly popular, especially among foreigners looking for stable returns, property ownership rights, and long-term value. We will give you a clear breakdown to help you get started.

Why Invest in Japan Real Estate?

-

(land + building)

No citizenship or residency required

You do not need to be a Japanese citizen, permanent resident (PR), or even live in Japan.

Foreigners can buy 100% freehold ownership, including:

Houses

Condominiums

Commercial buildings

Land (urban or rural)

Requirements:

Passport (if abroad or visiting)

A notarized signature (if registering from overseas)

Japanese judicial scrivener to register the deed

Japanese tax representative (if non-resident)

Bank account in Japan (if buying with a mortgage or paying utilities)

Caution:

While ownership is allowed, financing is harder:

Most Japanese banks require the buyer to have:

Long-term visa

Stable income in Japan

Often PR or Japanese spouse

If not, cash purchases are common for foreign investors

No:

No foreign ownership bans in Japan (unlike Thailand, Indonesia, etc.)

No special permits required for foreigners to buy land

-

Stable Legal System

Japan's legal framework is based on civil law, with clear, codified rules.

Property rights are well protected, including for foreigners.

Real estate transactions are registered with the Legal Affairs Bureau (法務局), ensuring transparency and traceability.

Courts are independent, and contracts are generally enforced reliably.

Example: If you legally purchase a property, your ownership is secure—even as a non-resident foreigner.

🕊️ Low Corruption

According to Transparency International, Japan consistently ranks among the least corrupt countries in Asia.

Public officials, judges, and police generally maintain a high degree of professionalism and integrity.

Real estate processes (permits, titles, taxes) are governed by clear procedures—not bribes or political favors.

✅ Foreign buyers rarely face “under-the-table” issues common in some other countries.

Real Estate Reassurance

Brokers and agents must be licensed, and their role is regulated under the Real Estate Business Law.

Legal documents are reviewed by judicial scriveners, and most deals require notarized contracts and official registration.

Disputes are rare if you follow legal steps and use qualified agents.

-

1. Tokyo

Why: Economic center, massive population, stable rental demand

Tenant type: Young professionals, expats, singles

Yield: 3–5%

Entry cost: High

Popular wards: Shinjuku, Minato, Taito, Setagaya, Nerima

Best for: Long-term rentals, capital preservation

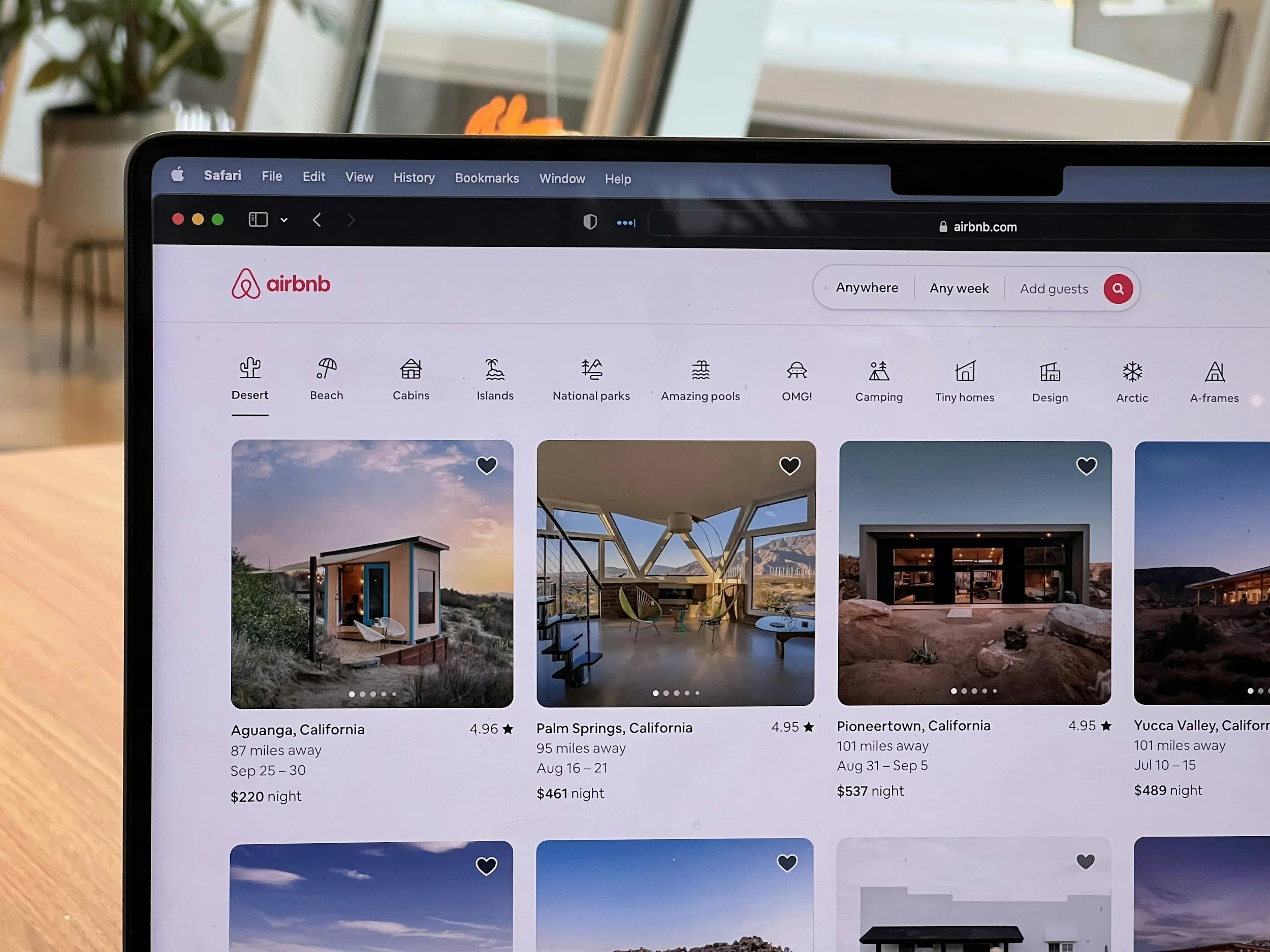

🌆 2. Osaka

Why: Tourism, commerce, growing Airbnb potential

Tenant type: Students, tourists, urban professionals

Yield: 5–7%

Entry cost: Medium

Popular areas: Namba, Shin-Osaka, Tennoji, Nishi-ku

Best for: Short-term rentals (Airbnb), higher yields

🏞️ 3. Fukuoka

Why: Fastest-growing major city, low entry barrier

Tenant type: Students, returnees, families

Yield: 5–8%

Entry cost: Low

Popular areas: Hakata, Chuo, Sawara

Best for: Long-term growth, mid-budget investors

🏯 4. Kyoto

Why: Cultural capital, tourist hub

Tenant type: Tourists (Airbnb), students

Yield: 5–8% (short-term)

Entry cost: Medium to high

Popular zones: Gion, Higashiyama

Best for: Short-term rentals (with license)

🏔️ 5. Niseko (Hokkaido) / Okinawa

Why: Resort markets, seasonal tourism

Tenant type: Foreign tourists, retirees

Yield: High (seasonal)

Entry cost: High (Niseko), Low–Medium (Okinawa)

Best for: Vacation rental investment

-

In Japan, especially outside ultra-central Tokyo; many properties are cash-flow positive, meaning:

Rental income covers (or exceeds) your monthly ownership costs, including loan payments, taxes, and maintenance.

This is largely due to:

1. Low Property Prices (Especially Used Homes)

Japan’s property prices are relatively affordable compared to other developed countries.

For example, you can find:

Used 1K/1LDK apartments in Tokyo suburbs: ¥8–15 million

Small apartment buildings (5–10 units) in Osaka, Fukuoka: ¥25–50 million

Akiya (vacant homes) in countryside areas: from ¥1 million!

2. Steady Rental Demand

Monthly rents are fairly stable, even in aging properties.

A ¥12 million 1K unit in suburban Tokyo might rent for ¥60,000–¥75,000/month.

That’s ~7–8% gross yield.

High tenant turnover is common, but occupancy remains relatively strong with the right location and price.

3. Sample Cash Flow

Let’s say you buy a ¥12 million used unit in Saitama (Tokyo suburb):

Loan (1.5% / 20 years): ~¥57,000/month

Rent: ¥70,000/month

Mgmt, taxes, fees: ~¥8,000/month

Net Cash Flow: ~¥5,000/month profit

Multiply this over several units and you build positive cash-flow income while property appreciates slowly (mainly land value in Japan).

Caveats:

Depreciation is fast on buildings—land retains most value.

Older buildings need renovation (factor in ¥500K–¥2M).

Rural areas = high vacancy risk—focus on urban rentals.

-

Strong yields (3–8%), especially with older or suburban properties

Stable & Transparent Market

Japan is known for its legal security, clear regulations, and strong property rights. Foreigners can buy and own property freely, just like locals, with no restrictions on land or home ownership.

Affordable Opportunities

Compared to other developed countries, Japan offers incredible value. From rural akiya houses to luxury city apartments, there’s a wide range of price points for every investor.

High Rental Demand

Cities like Tokyo, Osaka, and Fukuoka have a steady demand for rentals from students, expats, and locals. This means potential for consistent rental income.

Long-Term Asset Growth

Even if you don’t get an investor visa, your property is a hard asset in one of the world’s most stable economies. Over time, land and well-located properties often hold or gain value especially in urban and resort areas.

Lifestyle & Legacy

Beyond profit, many buyers purchase property in Japan for personal reasons: a vacation home, a retirement plan, or something to pass on to family.

Inflation means Stability for investors

Japan’s inflation is low and stable compared to other countries. This creates a steady real estate market, making it a safe and affordable place to invest, especially for foreign buyers benefiting from favorable exchange rates.